With housing affordability and cost of living at their worst level in decades, many are faced with the two-fold problem of being unable to afford a mortgage and being unable to build savings fast enough to keep up with house price growth.

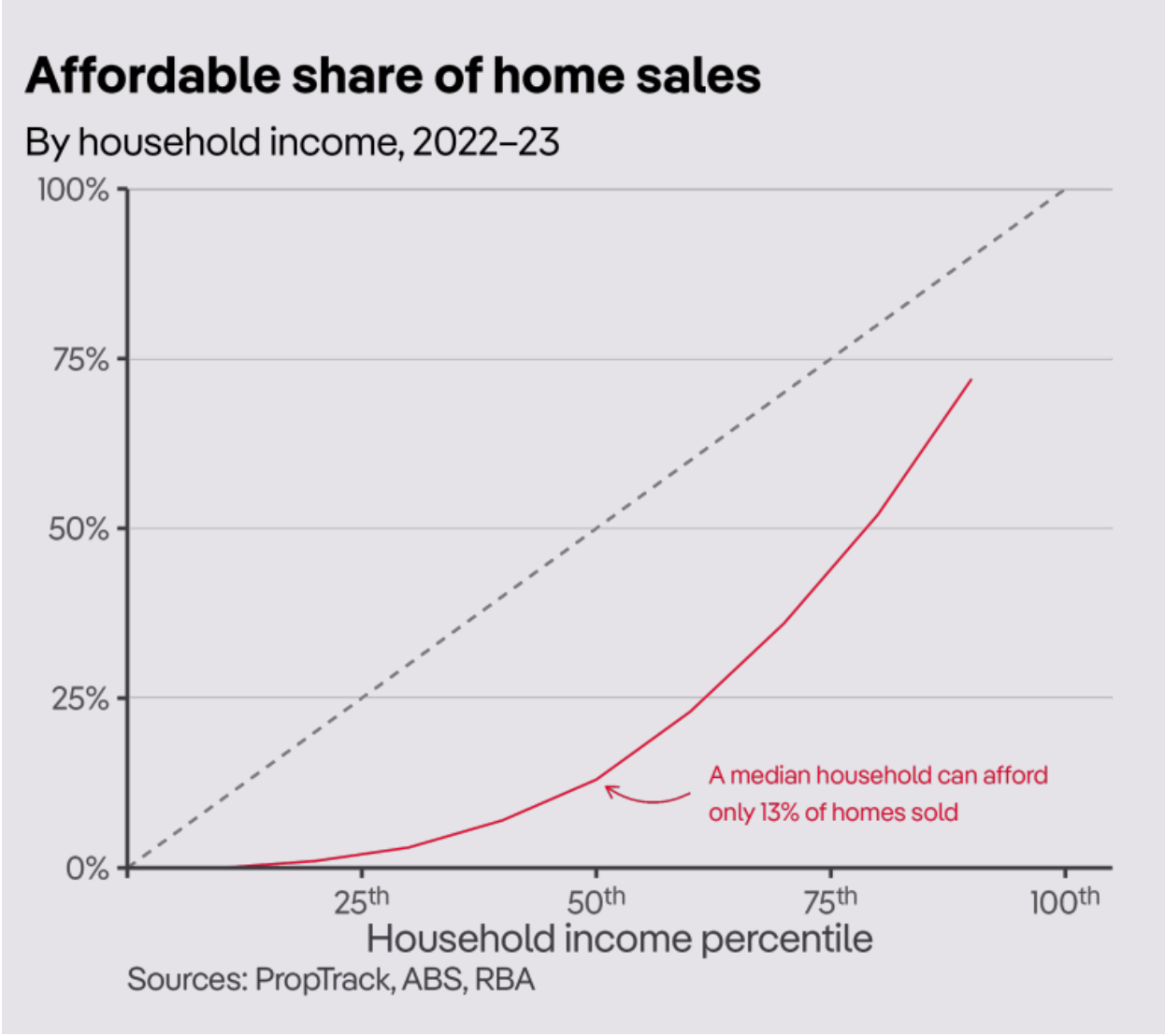

PropTrack's latest Housing Affordability Report even reveals that due to these dramatic mortgage rate increases and rising home prices, property seekers, whether first-time buyers or not, can now afford fewer homes than when records began in 1995.

Households earning the median (or typical) income in Australia can afford just 13% of homes sold nationwide, which is a significant drop from peak affordability levels in 2019-21 when a median income could afford around 40% of properties.

But obviously, affordability is just one barrier for first-time buyers entering the property market in Australia.

Saving a deposit big enough is also holding many would-be buyers back.

How long it takes first-home buyers to save a deposit

The good news here is that high-interest rates have turbocharged many savers’ property deposits.

But the issue is this has also been offset by a higher cost of living (meaning it's harder to put as much money aside) and robust property prices (meaning the deposit needed has remained steady).

Most mortgage lenders require a 20% deposit, otherwise, borrowers will be subject to higher interest rates and must pay mortgage lender's insurance (LMI).

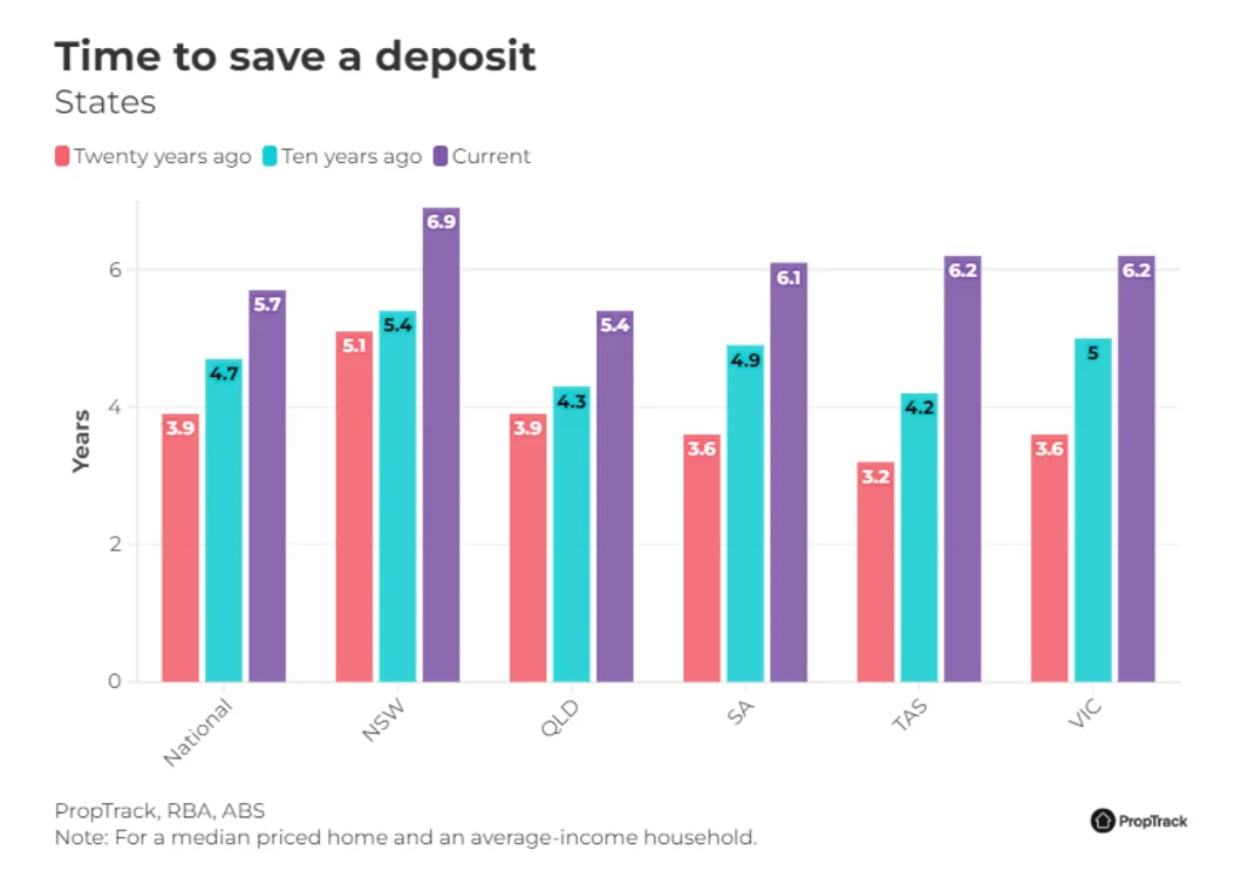

PropTrack calculates the time needed to save a deposit as the number of years a household earning average household income would need to save 20% of their gross household income to accumulate a 20% deposit on a median-priced home.

The data shows that an average-income household would need to save 20% of their income for 5.7 years to save a 20% deposit on a median-priced home.

Currently, the median property price in Australia is $678,500, which would mean saving $135,700 to avoid a higher mortgage rate and paying LMI.

Stamp duty costs are additional.

That’s a big jump from the 4.7 years needed to save a deposit just a decade ago, and the 3.9 years needed 20 years ago.

The time needed to save for a deposit differs depending on which state you’re looking to buy too.

The higher median-priced home in NSW means those earning an average income will need to save 20% of their earnings for a whopping 6.9 years to save the required median $172,000 deposit.

If you live in Queensland, the average household on a median income could have to save for a much shorter amount of time, at 5.4 years.

In the other major states - Victoria, South Australia and Tasmania - the time needed to save all hovers around 6.2 years.

First-home buyers make a slow comeback

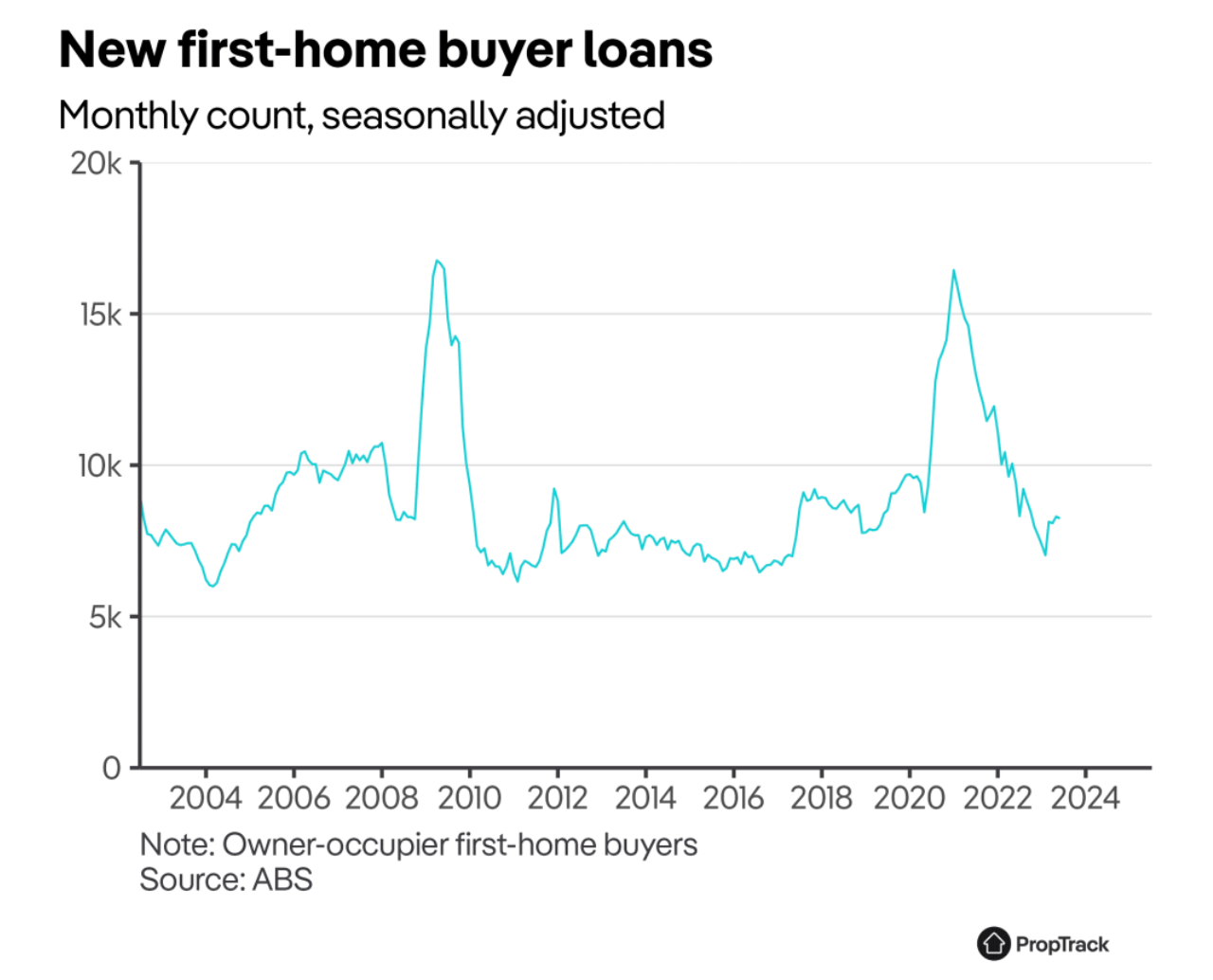

Since the number of new first-home buyer loans peaked in 2021, when interest rates fell to an all-time low, the data has done a sharp nosedive.

Loans to first-home buyers have plummeted, driven by increasing interest rates making it harder to afford a mortgage.

While there has been an uptick in the number of first-home buyers entering the market over the past few months, numbers still remain historically very low, PropTrack’s report author and senior data analyst Karen Dellow said.

“With expectations that interest rates are at, or close to their peak, and employment and wages growth likely to continue, the dramatic decline in affordability starting in late 2021 may begin to slow,” she said.

“However, affordability will continue to be an issue in Australia for the foreseeable future, especially as home prices continue to rise.”

There are ways for first-home buyers to reach their deposit quicker

- Make use of government grants

Government grants and stamp duty concessions available to first-home buyers can take some of the sting out of purchasing your first property.

Some of these are conditional, depending on things like the age or value of the property so be sure to check your eligibility before factoring these into your budget. - Move in with family or into a shared house

If you have the option, moving back home with family can help you save on rent costs, freeing up more cash for your deposit.

Alternatively moving into a shared house so you can split rent multiple ways will also afford you some big savings. - Reassess your budget

If you’re serious about saving for a deposit, a temporary reduction in luxury purchases where applicable is a great way to fast-track your savings.

There is still an opportunity for investors

While first-home buyers might struggle to get onto the property ladder in the current market, I do still think there is plenty of opportunity available for investors, whether new or seasoned.

Especially those with a long-term focus.

You see…we are at the beginning of a new property cycle, something that doesn’t happen very often.

Not that I suggest you try and time the market- this is just too difficult, and in truth, you’ve missed the bottom which occurred in early 2023.

But if the market hands you an opportunity like this, why not take advantage of it?

Taking advantage of the upturn stage of a new property has created significant wealth for investors in the past.

Moving forward, demand is going to outstrip supply for some time to come as we experience record levels of immigration at a time when we’re not building anywhere as many properties as we require.

Of course, in due course, consumer sentiment will rebound when it becomes clear that inflation continues to fall and interest rates have peaked.

At that time, pent-up demand will be released as greed (FOMO) overtakes fear (FOBE - Fear of buying early), as it always does as the property cycle moves on.

And strategic investors will take advantage of the opportunities our property markets offer over the next couple of years maximising their upsides while protecting their downsides.

But rather than trying to hunt down a bargain, focus on buying an investment-grade property in an A-grade location because these types of properties are in short supply but are still selling for reasonably good prices… Plus they’ll hold their value far better in the long term.

While it might feel counterintuitive to buy at a time when there are so many mixed messages in the media, you can benefit from less competition, low consumer sentiment, minimal downside risk and minimal risk of oversupply.